The recent All China Leather Exhibition (ACLE) presented a more positive outlook for the domestic and global leather supply chain after a pretty tough 2023 so far. The global economy, including the leather supply chain, needs Chinese consumers to start spending.

Like many people working in the international leather business, I did not know what to expect from the 23rd edition of the ACLE, which took place in Shanghai, August 29-31. But, like so many who managed to get an entry visa and through China’s post-Covid bureaucratic health requirements, the fair itself turned out to be a pleasant surprise. Several people told me that the ACLE “was much better than we had expected”. Microfiber Fabric Upholstery

Reviewing the various announcements made during the show, we now have data that supports how the leather and leather products markets in China have fared up to June of this year. It also provides some context to why so many industry professionals heading to Shanghai this year were not expecting too much from the fair. Leather, footwear, leather goods and garment manufacturing in China all fell year-on-year in the first half compared with 2022 according to the official data released by the China Leather Industry Association (CLIA).

The Chinese tanning industry (which is still the largest in the world by volume) has underperformed over the first half of 2023 compared with the corresponding first six months of 2022, when the country was still under full Covid restrictions.

However, consumer confidence globally has been at a low ebb this year and not just in China. The average consumer is having to spend more of their hard-earned cash on food, energy and rising mortgage or home rental costs. This has left less to spend on non-essentials which includes most leather products. Despite China’s GDP growing by an enviable 5% to 5.5% this year, it is still below where many market analysts expected it to be. More recently, the Chinese government has stepped in to reduce interest rates and provide some economic stimulus to bolster its slowing economy.

According to some comments made in Shanghai, some think that as most global economies emerged from Covid restrictions in early 2022, there was an initial burst of activity and an uptick in consumer spending following the reopening of high streets. Manufacturers and retailers (shoes, bags, garments, leather goods) reacted to fill in the gaps and production ramped up, while some consumers opted to spend cash that they had saved up during the lockdowns.

Further evidence to support this theory can be seen in raw materials trends, where hide prices started to rise in the final part of 2022 only to fall back after the bounce. This was expected when China re-opened post-Covid and then failed to provide any momentum, aside from a short-lived lift around the Chinese New Year which fell away by early Spring.

While the Chinese government kept Covid restrictions in place for far longer than elsewhere, the fallout from Putin’s early 2022 Russian invasion of Ukraine has caused consumer energy bills in the West to soar and prices of food, rent and other everyday items to rise at a faster pace than wages can keep up with.

The recovery in global markets evaporated, which was coupled with overstocking in the supply chain; while many mainstream brands have been working through stocks before looking to replenish. Despite China relaxing its restrictions in late 2022, there followed a lull in production of leather products at global level except for in the luxury leather goods segment and maybe a recovery in the automotive industry once the semi-conductor supply issues were addressed.

The People’s Bank of China reduced its one-year loan prime rate, used as a benchmark for corporate lending in the world’s second largest economy, to 3.45% from 3.55% on August 21. However, the central bank had also been expected to lower the five-year loan prime rate, which is used to price mortgages in China, but it decided to leave that interest rate unchanged at 4.2%.

Consumers in China are spending less amid record levels of youth unemployment, while concerns about the health of the country’s property sector have chilled investment. Housebuilding has slumped and exports are contracting in the face of subdued international demand.

Property prices have fallen by 0.3% in China over the past year, fuelling concerns about economic growth. In late August, and in the run up to the ACLE, analysts slashed their GDP forecasts for 2023, with most now expecting China to miss its annual growth target of about 5%.

China’s initial recovery after it ditched its strict zero-Covid policy has run out of steam, amplifying the hit to the global economy from tighter interest rates and high inflation. However, Beijing has been cautious about committing to mass stimulus amid fears that it could pump too much debt into an already precarious property sector. A rise in government spending and tax cuts alongside looser monetary policy have been seen as necessary to support the economy.

China Evergrande Group, one of the country’s biggest housebuilders with US$340 billion of debt on its balance sheet, filed for bankruptcy protection in the United States in mid-August. Its near-collapse two years ago rattled global financial markets as the large home developer filed for Chapter 15 bankruptcy protection, which can shield the American assets of overseas companies while it tackles its debts in New York.

Country Garden, a rival developer, similarly has missed payments on its debt. The company will likely lose its position on Hong Kong’s Hang Seng stock index this month. Country Garden, which is another Chinese property developer that is virtually unknown outside Asia, has fallen behind on its bond payments, sending fresh fears through jittery global markets.

Last year, the company sold almost 700,000 flats and houses, more than any other Chinese developer. However, it recently failed to pay the $22.5 million coupon owed to its international bondholders, reigniting the cashflow worries that have dogged China’s property industry in recent years.

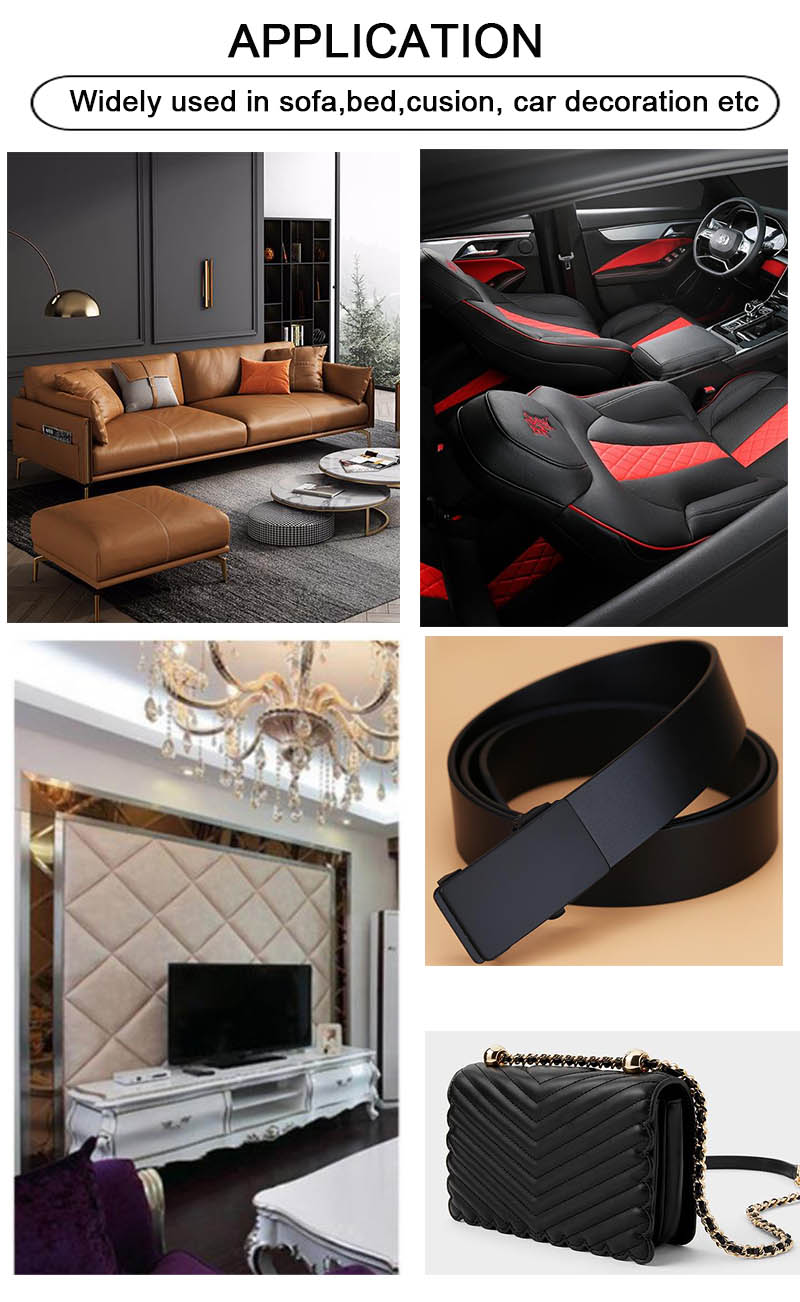

Despite the very real difficulties from the housing market in China, demand for furniture upholstery leather seems to be growing according to anecdotal feedback from some exhibitors the ACLE. However, these comments do seem to go against what’s being observed in the wider economy.

Another more optimistic segment appears to be around the domestic automotive industry which is booming and fully embracing the switch to electrification. Since the ACLE was last held in 2019, the streets of Shanghai are filled with more and more Chinese homemade brands, especially electric vehicles, and unlike their European counterparts the Chinese OEMs are very much focussed on providing Chinese consumers with a leather interior. Leather is still the material of choice it would seem for Chinese car buyers.

What should be China’s most positive and best-educated generation is under threat for the first time in three decades of continuous economic boom.

Rising youth unemployment, which hit 21% this summer, has led not only to the authorities deciding to no longer publish the figure, but to a crisis in confidence among China’s university leavers, who thought they were guaranteed jobs in the booming technology, engineering and creative industries.

Now, however, they are finding themselves in the same position as their recession-hit western counterparts, and are having to look for jobs such as waiters and bar staff.

Despite the many issues facing China and the global economy in general, a visit to the ACLE did provide a feeling of optimism that the situation is set to improve. Only time will tell.

Despite differences politically and an ongoing trade war, the relationship in the leather industry between the North American tanners and traders and their Chinese counterparts is positive. There was a genuine warmth between the two parties when the LHCA (Leather and Hide Council of America) hosted a reception in Shanghai with the CLIA on August 30.

For many in the Chinese leather and leather products industries, the ACLE represented the first live event in four years where they could meet and see what was on offer from suppliers such as chemicals, machinery and raw materials and meet face-to-face. Visitor numbers to the show were up by over 35% on the first day of the show compared with the last event in 2019 and the aisles remained busy throughout the fair. Nearly all the visitors were from China with thousands reportedly bussed in from places such as Xinji and Wuji to attend.

In a press conference on August 29, CLIA Chairman, Mr Li Yuzhong said that they were expecting domestic consumer markets to recover in the second half of 2023 and into 2024. He also expected that domestic Chinese brands would continue to grow their market share, especially in the home market, while the sector was focussing more on scientific, environmental and technological innovation to futureproof itself. “Sales channels will continue to evolve, online platforms will become increasingly critical and online sales will continue to increase (in China)”, he said.

I asked Li Yuzhong what evidence he had to support the CLIA’s predicted growth in demand, and he said that the Chinese government was providing stimulus measures to support Chinese consumers, which he said would also help the leather industry. Clearly, the busy activity at the ACLE provided further evidence that the market situation, in China at least, is looking more optimistic about the future. Everyone in the leather supply chain is just hoping that the positivity from the fair is matched by an uptick in demand. With raw hide prices stabilising since Shanghai, the early signs are encouraging. Let’s see if the upcoming fairs in Milan later this month can build on the momentum from Shanghai.

Upholstery Fabric That Looks Like Leather International Leather Maker is a business information brand produced by Edify Digital Media Ltd